Financing and Refinancing Scenarios

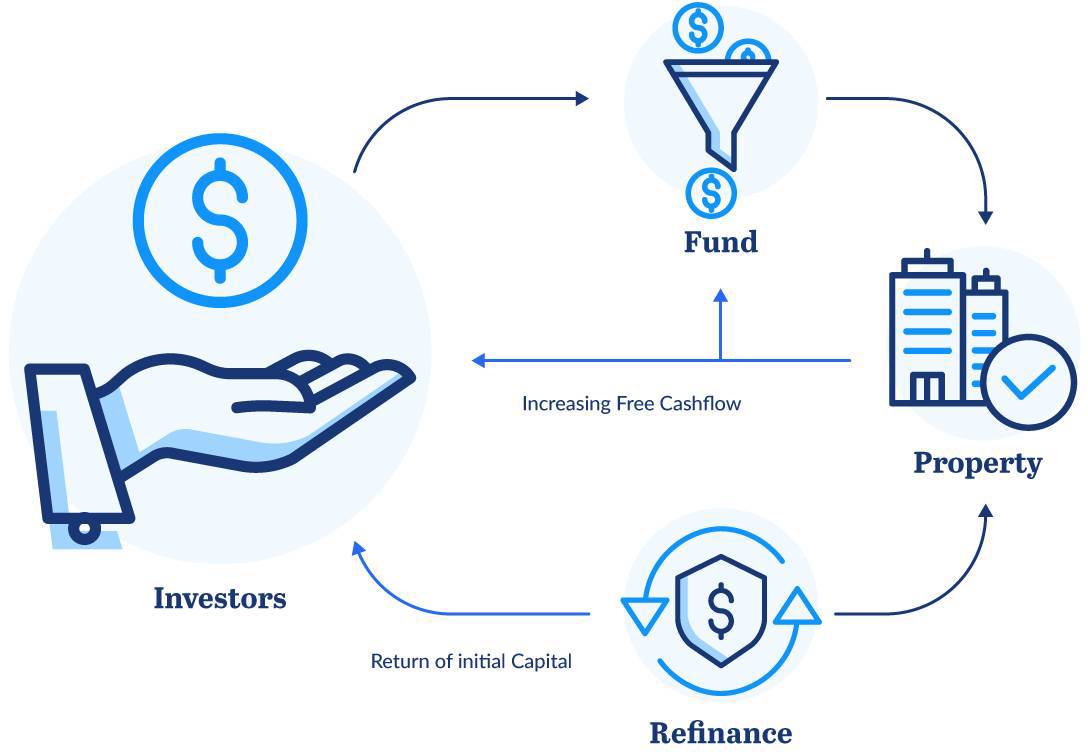

Correctly financing and then refinancing the properties allows the fund and investor to “buy right” and to then withdraw their initial capital while maintain their equity positions in the properties.

Leverage is used to amplify and maximize the fund and investors’ buying power, and then to unlock the inherent, post-stabilized, increased property values. However, each investors’ leverage risk is limited to only their initial capital amount. This increases potential upside buying power, while limiting downside risk.

Downside Protection

While investing capital has its inherent risks, an inherent downside protection built into the Sarmaya Model, should refinancing be unavailable or inopportune at any particular time, is the Capitalization Rate of each property. This “Cap Rate” protection while the property is held, even prior to refinancing, allows the investor to enjoy a return based on the investments’ free and ideally increasing cashflow.